Mortgage comparison websites are the best way to find the mortgage that best suits the situation and the specific needs of consumers. These tools are online and free in most cases, such as on idealista, and their main advantage is being able to offer a panoramic view of the market, allowing you to save time, as well as providing very relevant information when choosing between one loan or another, such as the final interest rate. These are the reasons to use a mortgage comparison site when buying property in Portugal.

It offers a panoramic view of the mortgage market

The first advantage of using a mortgage comparison site in Portugal when you are going to ask for a home loan is that it gives you a panoramic view of the mortgage market. In other words, it will not just show you the offers of one bank or another, but all the offers available on the market at that moment. In this way, you can compare things not only in the same entity, but also between different banks.

Provides very relevant information when making a choice

Another of the main advantages to bear in mind when using a mortgage comparison tool is that it will offer specific and highly relevant information. For example, the APR of each financing. In other words, what you will actually pay for taking out each specific product.

Offers searches based on personal profile

A mortgage comparison site takes into account the profile of each customer, thanks to the information provided. This way, you can select the mortgages that really meet your needs and demands. In other words, it takes into account if you can access a mortgage for young people, if you have a fixed salary or if you are self-employed, which house you can afford, etc.

It's totally safe

A mortgage comparison site, such as the one offered by idealista, is totally safe to use. The data that it uses are only those strictly necessary for the study of each specific case, all of them are treated following the necessary measures to guarantee the total security of the data and the clients.

It is a price and mortgage credit comparison tool

On the other hand, it can be said that a mortgage comparison site is also a price comparison tool. In general, apart from the general conditions, one of the aspects most taken into consideration when comparing mortgages is the final price to pay for each of the products you are comparing. In this sense, resorting to a mortgage comparison tool is one of the best ways to save money on the loan you are going to take out.

It allows you to save a lot of time

Another advantage of using a mortgage comparison site is that it helps you save time. How? Imagine you need to contact all the banks and then compare each of the products they offer? How long would it take you to do that from scratch?

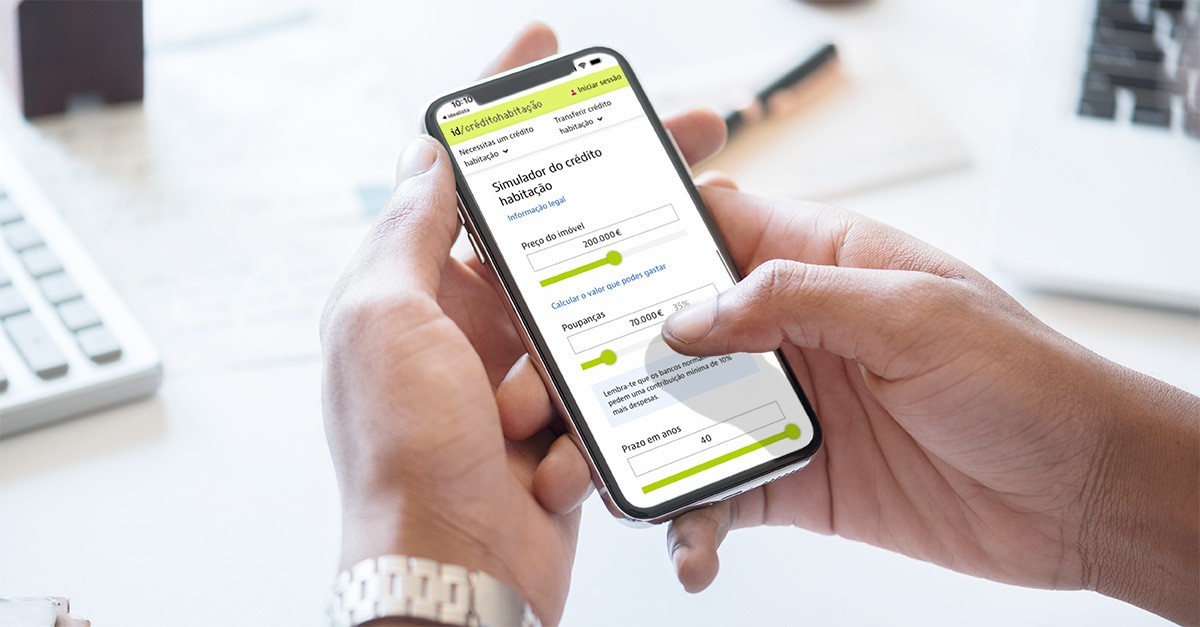

It offers greater comfort because it is a digital method

Likewise, you cannot forget that a mortgage comparison site, because it is done digitally, offers much more comfort and is more practical, being able to be done from home and without the need of even phone call. Just enter the data and the computer gives you the results in a few seconds.

A mortgage comparison site is free of charge

Another advantage of mortgage comparison sites like idealista is that it is free. This is something that always comes in handy, especially when thinking about the possibility of buying a house with bank financing.

It allows you to make the best decision

The use of a mortgage comparison tool helps you to make the best decision, since it provides specific and relevant information that you need to choose the loan that best suits your needs and characteristics as a client. In this way, you avoid having to settle for the first credit solution you see or for the product that your usual bank offers us.

Finally, it is important to remember that when you use a mortgage comparison site, what we are going to get are several generic offers. Therefore, it is very important to present the operation in several banks and thus be able to see the specific offers that each entity makes. In this way, you can be sure that you find the Portuguese mortgage that really suits your needs.