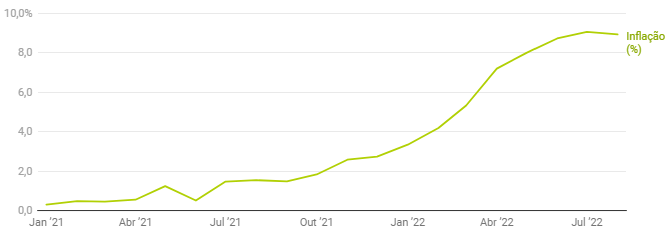

The prices of goods and services are usually updated at the beginning of each year. But the inflationary spiral that is raging in Europe is causing this update to be brought forward. In Portugal, inflation was 9.0% in August (9.1% in July), according to provisional data from the National Statistics Institute (INE). And this is reflected in the rising cost of the contents of the average shopping basket at the supermarket, as well as in the increase in rent, electricity and gas bills, fuel, restaurant bills and leisure activities. That's why the Portuguese Government presented a package of measures on Monday 5th September to help those living in Portugal mitigate the effects of inflation on their household budgets. But how much are the prices of specific goods and services rising? This is how inflation is impacting the cost of living in Portugal in 2022.

Widespread price rises in the various sectors of the economy

All the goods and services related to energy and food are those that have weighed most heavily on the pockets of those living in Portugal, and will continue to do so in September. And although energy and food products are more vulnerable to changes in the world economy, the Bank of Portugal has already warned that inflation is spreading to goods and services that have historically had more stable prices. Examples are some education and health services, rent and restaurants and cafés.

So, how is inflation pushing up prices in the various sectors of the Portuguese economy? We explain point by point:

More expensive mortgages due to higher interest rates

If you have bought a house with a mortgage in Portugal, sooner or later you will see your mortgage payment go up - if your mortgage is indexed to the Euribor. So, if the loan is indexed to 12-month Euribor and is revised in August, a rate of 1.249% will be applied over the following twelve months. And if the contracted rate is Euribor 6 months, the interest will be 0.837%. In both cases, families will see their mortgage payments go up by several dozen euros.

On this point, the Government has not yet announced a concrete measure, but the Minister of Housing, Pedro Nuno Santos, advanced that the Socialist Executive is "prepared" to move forward with further measures to deal with mortgage payments and the increase in interest rates.

Buying property in Portugal: prices continue to rise

Those who already had it in their plans to buy a home are speeding up the process, giving rise to a rush to the housing market. Between January and March 2022, 43,544 homes were transacted, which represents a year-on-year rate of change of 25.8%, INE revealed in June. This is because house prices rose 17.2 per cent in the first three months of 2022 compared to the same period last year.

In median terms, buying a house cost 1,241 euros per square metre between January and March 2021 and in the same period of 2022 it cost 1,454 euros/m2 (i.e. 213 euros/m2 more). This upward trend in the cost of buying a home is worsening given the shortage of labour in construction and rising material prices.

Rental prices in Portugal: limited increases in 2023

Tenants can breathe a sigh of relief until the end of the year. And now the Government led by António Costa has limited the updating of housing rents in 2023 to 2% - note that the index of rental updates for next year was already at 5.43% having been driven by inflation.

However, anyone wanting to rent a house in Portugal today will find the market even more inflated also due to the imbalance between supply and demand: rents increased 2.7% in July 2022 when compared to the same month in 2021, according to the latest data from INE. On top of this, the latest data from idealista indicate that renting a house in Portugal was 1.4% more expensive in August compared to the previous month.

Back to school: costs increased 16% compared to 2021

Although in public schools in Portugal students have free books until a certain age, there are other school supplies that you need to buy to start the school year. And these are also becoming more expensive. According to Jornal de Notícias - which is based on several studies - to buy the necessary materials, an average of 350 euros per pupil in primary school and 600 euros per pupil in secondary school is needed. Back-to-school costs have increased by 16% compared to last year, according to the same publication.

More expensive groceries in Portugal

Food is becoming increasingly expensive, both because of the interruption of grain supplies from Ukraine and Russia, and the increased cost of energy and transport needed to produce and deliver the products, respectively. According to INE, the price of unprocessed food rose 15.44% year-on-year in August (13.22% in July).

And a study carried out by the consultancy firm Kantar for Centromarca - the Portuguese association of branded products companies - revealed in May that the Portuguese consumer's shopping basket is the smallest in the last four years, and is also more expensive. Just between the first three months of 2022 and the same period of 2019, the volume of purchases fell by 2.8%.

To address these and other increases in the cost of living for Portuguese residents, António Costa announced other support measures that will be paid out in October:

- A cheque worth 125 euros to each non-pensioner citizen with an income of up to 2,700 euros gross per month. The cheque will be paid automatically via the Tax Office or Social Security;

- 50 euros support to families with children up to 24 years old (value per descendant) also paid in October.

- Payment of an extra half pension to pensioners in 2022 and increase of pensions in 2023.

Eating out in Portugal: restaurant meals with rising prices

With food and energy costs on the rise, the cost of eating out has also gone up. The secretary-general of the Associação da Hotelaria, Restauração e Similares de Portugal (AHRESP), Ana Jacinto, presented in June to the Minister of Economy "a vast set of measures to support the catering companies" and similar, to tackle "the perverse effects of the pandemic and inflationary situation". But so far, these "have not yet been welcomed", she warned, quoted by Lusa.

In Spain, the rise in energy and raw materials has led two out of three restaurants to raise the price of the daily menu by between 5% and 10% between November 2021 and April 2022, reports El País.

Fuel prices: measures in place are to be maintained

The Government has decreed discounts on the ISP (Tax on Petroleum Products) on the cost of fuel, reducing the equivalent to applying a VAT rate of 13%. And this measure will be maintained until the end of the year. Also the updating of the carbon tax will remain suspended until the end of December. Even so, given the context of the war in Ukraine, the sale price of plain diesel rose by 10 cents per litre at the start of September, increasing the price to 1.88 euros/litre. Petrol, on the other hand, is expected to have stabilised at 1.78 euros/litre.

More expensive electricity and gas: there are more support measures

With the energy crisis in Europe, electricity prices in Portugal increased by 35% at the start of September to 365.33 euros a megawatt per hour, the sixth most expensive ever, according to official data. To cope with this increase, the socialist government has decided to reduce VAT on electricity supplies from the current 13% to 6%, a measure in force until December 2023.

And in the case of gas price increases, the Government has set maximum prices for each barrel. A 13kg barrel of butane, for example, will have a maximum value of 29.47 euros. In addition, António Costa's government will allow gas consumers to return to the regulated market, he announced on Monday. Thus, "a couple with two children will see the price of the bill decrease 10% if they switch from the free market to the regulated market", explained the Prime Minister.

Note that Portugal will have to reduce 7% of gas consumption between the months of August 2022 and March 2023, a solidarity measure with the countries of Europe in order to mitigate the effects of a possible cut in supply of Russian gas on European soil.

Consumer loans rising to meet expenses

The uncontrolled rise in prices is causing consumer borrowing to rise in order to pay for expenses such as back-to-school materials, holidays and home renovations. The most recent data from the Bank of Portugal reveals that the amount of consumer loans has been rising in 2021 and 2022 and reached an all-time high in July 2022, with 20,325 million euros having been granted. In this case, interest rates have been above 7.5% since January 2022.