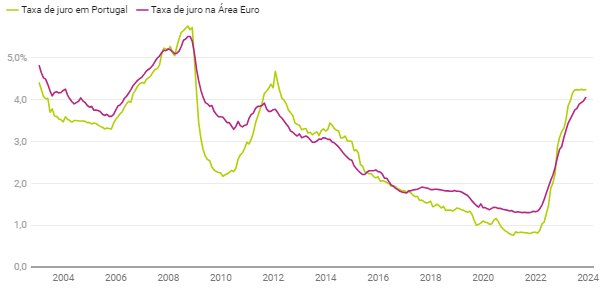

In Portugal, average interest rates on new home loans have been stabilising at 4.2% since June. And in the euro area, average interest rates continue to rise, having reached 4% in November for the first time since 2009. But even so, Portuguese banks are charging more interest on home loans than the Eurozone average, a trend that has been visible since October last year, as revealed by the most recent data from the Bank of Portugal (BdP).

"The average interest rate on new home loans was 4.24% in November (4.23% in October). This rate has remained relatively stable since June and has been converging with the euro area average (4.05% in November)," explained the BdP in a statement released in January 2024. This means that, despite the fact that interest rates in Portugal are increasingly closer to those charged by banks in the euro area, the truth is that the Portuguese continue to pay more for new home loans than the Eurozone average.

BdP data thus shows that the interest rate on new loans in Portugal has been higher than the euro area average for housing since October 2022, with the biggest difference being recorded in May 2023 (average interest in Portugal was 4.16 per cent, while the euro area average was still 3.64 per cent). This trend is explained by the fact that, between October 2022 and July 2023, the variable rate indexed to Euribor continued to represent the majority of new contracts in Portugal, which resulted in a greater and faster adjustment of the interest charged by Portuguese banks to the successive increases in key interest rates decided by the European Central Bank (ECB).

The graph below shows the evolution of mortgage interest rates on new home loans in Portugal and the Euro Area.

Why are interest rates on new mortgages in Portugal stabilising?

The evolution of average interest rates on new home loans in Portugal has been stabilising since June, while average interest rates in the euro area continue to rise and absorb the European regulator's high refinancing rate (4.5%). There is therefore greater convergence between the two rates after the ECB stopped raising the key interest rates at its October and December meetings, since the average rates charged by banks in Portugal are already at the same level as the ECB's rates.

In addition, given the rapid rise in Euribor rates, households in Portugal have been adapting their demand for new home loans, increasingly opting for mixed rates (they account for 66% of new contracts in November), which combine an initial fixed rate period (which is cheaper), followed by a variable rate period. This trend has also helped stabilise the average interest charged in Portugal.

It's important to note that the average interest rates on new mortgages in Portugal have not always been higher than those in the euro area. For example, between 2017 and September 2022, Portuguese banks had lower rates than the European average, at a time when new home loans were mainly indexed to variable rates and Euribor rates were falling.

- If you're planning on buying a house in Portugal and need a mortgage, our mortgage experts at idealista/créditohabitação are here to help.