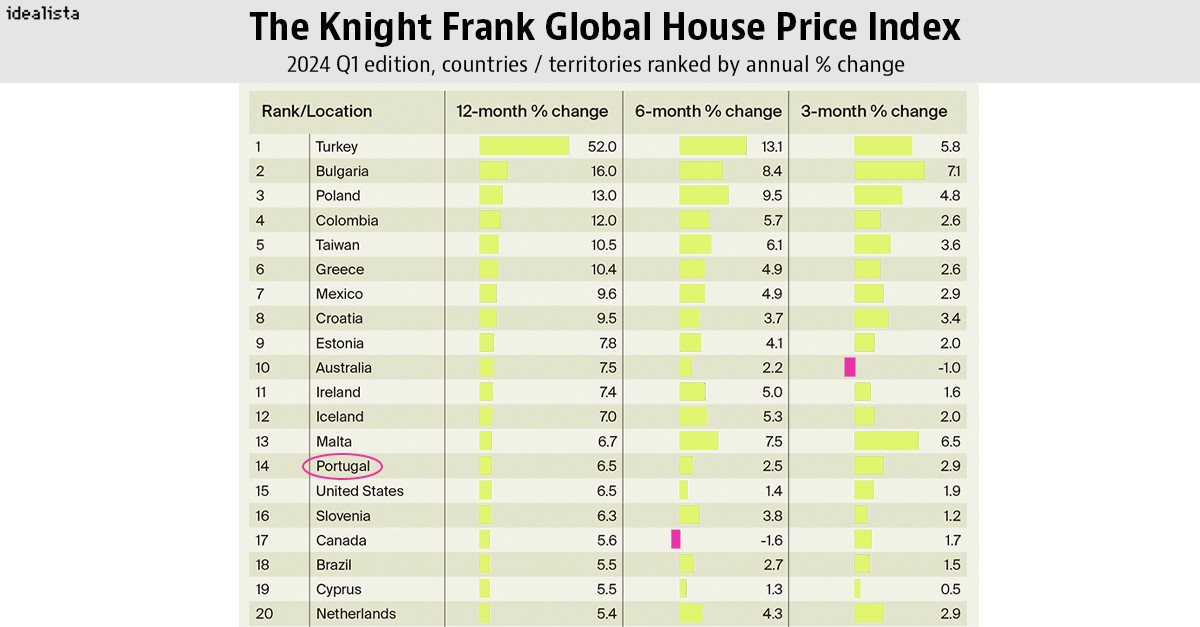

House prices in Portugal continue to rise, having increased by 6.5% over the past year, 2.5% over the past six months, and 2.9% over the past three months, according to the Knight Frank Global House Price Index. Portugal ranks 14th in the index among 56 countries analysed, ahead of countries such as France, Germany, Switzerland, and the USA.

"This growth shows that Portugal remains an attractive country for foreign investments and that our economic stability gives positive signals about the market," stated Francisco Quintela, CEO of Quintela e Penalva, Knight Frank's partner in Portugal, in a press release.

Among the 56 countries analysed, Turkey tops the ranking. Despite housing prices having increased by more than 50% over the past 12 months until March, they decreased by 9.9% in the past year, as revealed by the real estate agency.

Following Turkey in the table are "Bulgaria (16%), Poland (13%), Colombia (12%), Taiwan (10.5%), and Greece (10.4%)", which "are the only countries [besides Turkey] where the market saw growth above 10%," according to the statement.

"The Australian market, with 7.5% growth over the past 12 months, however, recorded a 1% decline in the past three months," Knight Frank added.

Highlight also the fact that European markets account for 8 out of the 11 markets that saw price declines: France (-5.2%) and Germany (-3.9%), for example, felt "the effects of slower economic growth and high inflation".

The report concludes, among other things, that there is an acceleration in global housing price growth, with the average annual price growth reaching 3.6% over the past 12 months until March, up from 3.2% in the previous six months.

"Real estate markets continued to see strong growth in the first quarter of 2024, at 3.6%. This marks a significant improvement from the 2.2% growth recorded in the second quarter of last year, when markets absorbed the impact of the global rise in interest rates since early 2022," the statement reads.

"Even with prices rising annually at a rate of 3.6%, this is below the trend of 5.6%. Quarterly growth stands at 1.3%, an increase from the past two quarters but still below the long-term average of 1.4%," Knight Frank notes.

Quoted in the document, Liam Bailey, global head of research at Knight Frank, points out that "house prices increased last year in most global markets." He issues a warning: "Many markets are suffering from a lack of homes for sale, as well as slow construction, which leads to relatively healthy demand, pushing prices to new highs. In the long term, however, only lower debt costs will sustain price growth."