In an international context marked by geopolitical tensions in Ukraine and the Middle East, uncertainty over the duration of the European Central Bank's tightening of monetary policy and a deterioration in the economic outlook, "the likelihood of a price correction in the residential property market is likely to increase", warns the Bank of Portugal (BdP).

In its analysis of the main vulnerabilities to financial stability in Portugal, the Portuguese regulator pointed to the risk of "a price correction in the residential property market, boosted by the uncertain macroeconomic scenario", marked by rising interest rates and geographic instability. The Financial Stability Report for November 2023, published this Wednesday, states that "the macroeconomic scenario is uncertain", characterised by rising interest rates and geopolitical instability. In addition, "the recent political uncertainty in the country is a new source of risk, although mitigated by the expected approval of the State Budget for 2024 proposed by the current government," he added.

This risk of house prices falling stems from the cooling of demand, which is already clearly visible in the country:

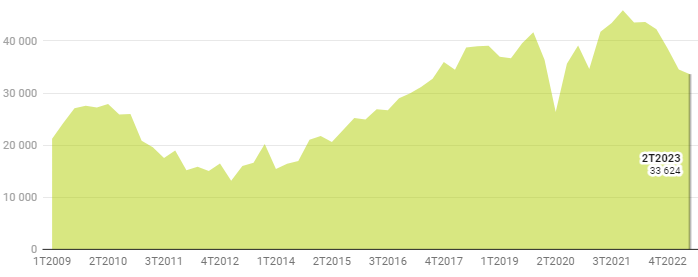

- house sales are falling: the number of transactions fell in the first half of 2023, down 22% year-on-year (-10% in the second half of 2022);

- The average time to sell a property stabilised at around 6 months in the first half of 2023, following the reduction seen in 2022;

- Home loans falling: new home loan operations (excluding renegotiations) contracted by 20% year-on-year between January and September 2023.

House sales in Portugal

On the other hand, demand for homes in Portugal has been sustained by foreigners. "Portugal's geographical location and the conditions of security and stability that have made it a desirable destination continue to support demand from non-residents and foreign residents," emphasises the regulator led by Mário Centeno.

In the last decade, "the increase in the participation of non-resident buyers has characterised the residential property market in Portugal". And in the first half of 2023, the share of the residential property market held by buyers with tax residency outside of Portugal increased by 2 percentage points compared to the same period in 2022, to 12.7% of transactions.

There are also those who continue to seek out Portuguese residential property as an investment asset. Although "alternative savings investments have become more attractive recently, in a context of volatility in the financial markets and economic uncertainty, this asset remains relevant in terms of portfolio diversification," explains the BdP. In addition, "higher inflation may promote demand for residential property as a store of value," he adds.

Housing supply limits impact of falling prices

What the BdP also says is that "the limited supply of new housing and the lack of an accumulated stock of available homes mitigate the impact on prices in the event of a reduction in demand".

The truth is that there are more new homes for sale, but supply is still short of demand. "The number of dwellings put up for sale increased in the first half of 2023 compared to 2022, after the reduction observed between 2014 and 2021," the Portuguese regulator recalls. This happened despite the obstacles to construction activity in Portugal, namely the shortage of labour, the level of interest rates and the lack of materials.

In addition to the lack of supply, "construction costs have remained high, although they have slowed down in recent months", so "these may continue to be reflected in the price of properties traded and, in particular, new buildings", he adds.

Therefore, limitations in the supply of new housing, the lack of an accumulated stock of available homes and rising construction costs have all contributed to the increase in house prices in the country. "The house price index in real terms continued to rise in Portugal until the second quarter of 2023, while in the euro area it fell from the first quarter of 2022 onwards," says the BdP. INE data shows that house prices in Portugal rose by 8.7% year-on-year in the same period.

In addition, "developments in the rental market have kept pace with developments in residential property transaction prices. In the second quarter of 2023, the median value per square metre of new rental contracts increased by 11% year-on-year," the document reads.

Evolution of house prices in Portugal