Access to housing is becoming increasingly difficult across Europe, with house prices rising far faster than household incomes in recent years. Portugal, in particular, stands out for all the wrong reasons: it is one of the EU Member States where housing costs have more than tripled over the last decade. In fact, the European Commission (EC) estimates that Portugal has the most overvalued house prices in the European Union (EU).

Brussels’ assessment of housing in Portugal is far from encouraging, primarily because it concludes that the country recorded the “steepest average overvaluation” in the EU, with house prices overvalued by 35%. “It was the only country where overvaluation increased significantly in 2024,” it adds. By contrast, in Luxembourg, the Netherlands, Austria, Greece, the Czech Republic, Sweden and Latvia, house prices are overvalued by between 10% and 20%, with this indicator decreasing in all these countries between 2023 and 2024, except for the Netherlands.

The recent Brussels report on housing in the EU also notes that the nominal growth in house prices exceeded 200% in Portugal between 2014 and 2024, as well as in six other countries (Hungary, Lithuania, the Czech Republic, Estonia, Bulgaria and Poland), well above the EU average increase of 50%. Real house prices—adjusted for inflation—also grew by an average of 25% across the EU over the past decade. “Real house prices increased most (over 50%) in Hungary, Portugal, Lithuania, Slovenia, the Czech Republic and Ireland,” the report published on Tuesday, 14 October, reveals.

But why are house prices rising so sharply in Portugal and across Europe? Market dynamics tend to adjust prices, but demand continues to far outstrip supply. On the demand side, real estate transactions picked up in 2024 following lower interest rates. Portugal is among the countries with the most active markets (also due to support schemes for young buyers), alongside Spain, Cyprus, Bulgaria and Poland, although in most EU countries house sales have yet to fully recover. On the other hand, “there is evidence that Portugal is the EU country where tourism has had the strongest impact on house prices,” concludes the EC.

“There is evidence that Portugal is the EU country where tourism has had the strongest impact on house prices.”

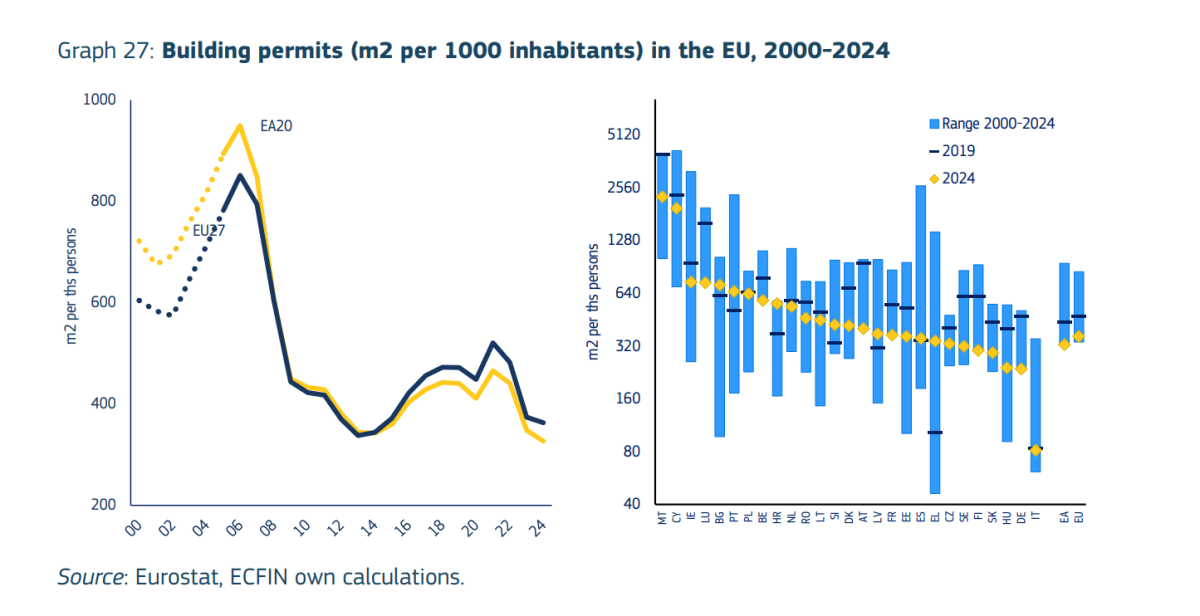

Furthermore, the supply side is failing to balance the market. “The release of houses onto the market is delayed due to regulatory barriers, rising construction and land costs, inefficiencies in the construction sector, and labour shortages,” Brussels notes. It also details that the “issuance of building permits fell sharply following the global financial crisis.”

“Historical comparison shows that building permits are close to historic lows in most EU countries, with some notable exceptions, namely Portugal, Croatia, Spain and Greece,” the report adds. Moreover, the processing of permits in Portugal is among the longest in the EU, taking up to 31 weeks—despite recent efforts to simplify the licensing process, which are expected to be reviewed soon by the Government.

This growth in house values, driven by the imbalance between supply and demand, further exacerbates access to housing in Europe, particularly because prices are rising far faster than household incomes, as Brussels concludes. “In Portugal, the Netherlands, Hungary, Luxembourg, Ireland, the Czech Republic and Austria, the largest price increases were recorded, with price-to-income ratios more than 20% higher than a decade ago,” the document states. By contrast, in Romania, Cyprus and Finland, house prices have fallen relative to incomes since 2014.