Lisbon has cemented its position as one of Europe’s most attractive cities for real estate investment, ranking among the top 11 destinations on the continent, according to the latest PwC report. This prominence reflects a combination of economic, urban, and social factors that give Lisbon a competitive edge over other European capitals, even amid geopolitical uncertainty and macroeconomic challenges.

The most attractive European cities for real estate investment in 2026

| City | 2026 ranking | 2025 ranking |

|---|---|---|

| London | 1 | 1 |

| Madrid | 2 | 2 |

| Paris | 3 | 3 |

| Berlin | 4 | 4 |

| Amsterdam | 5 | 6 |

| Munich | 6 | 5 |

| Milan | 7 | 7 |

| Barcelona | 8 | 11 |

| Frankfurt | 9 | 8 |

| Hamburg | 10 | 9 |

| Lisbon | 11 | 10 |

| Warsaw | 12 | 12 |

| Dublin | 13 | 17 |

| Brussels | 14 | 14 |

| Copenhagen | 15 | 16 |

| Rome | 16 | 19 |

| Vienna | 17 | 13 |

| Stockholm | 18 | 20 |

| Luxembourg | 19 | 18 |

| Manchester | 20 | 21 |

| Zurich | 21 | 15 |

| Birmingham | 22 | 24 |

| Prague | 23 | 23 |

| Helsinki | 24 | 25 |

| Edinburgh | 25 | 26 |

| Athens | 26 | 22 |

| Oslo | 27 | 27 |

| Lyon | 28 | 28 |

| Budapest | 29 | 29 |

| Bucharest | 30 | nd |

| Istanbul | 31 | 30 |

| Sofia | 32 | nd |

A strong urban ecosystem

Lisbon benefits from a robust urban structure, including efficient public transport, which not only improves quality of life but also supports the development of innovation hubs and economic clusters. These factors are key to attracting talent and driving sustainable economic growth.

The city has also shown an increasing capacity for public–private partnerships, aligning municipal objectives with institutional and private capital. This strategy enables the implementation of strategic urban projects—from affordable housing to digital infrastructure—while promoting both economic development and social cohesion.

What makes Lisbon attractive to investors

The report highlights several factors that make Lisbon an increasingly appealing investment destination:

- Liquidity and transparency: Critical for international investors, especially in volatile markets with rising interest rates.

- Sector diversity: Lisbon offers opportunities in housing, logistics, data centres, and energy infrastructure, providing stable, long-term returns.

- Urban innovation: Regeneration and modernisation projects integrating technology, sustainability, and design strengthen Lisbon’s competitive edge.

- Affordable housing as a strategic priority: Investment in quality housing supports labour mobility and reinforces the city’s industrial and technological growth.

Lisbon’s global positioning

Lisbon stands out in Europe for offering competitive costs compared to markets such as London or Paris, while maintaining high standards of living and legal security. Strategically located, the city is well-positioned to attract institutional and international capital at a time when investors seek resilient, operationally intensive assets.

Moreover, Lisbon is actively participating in European initiatives on energy transition, digitalisation, and social infrastructure, creating opportunities for investors looking to combine profitability with social impact and environmental sustainability.

Lisbon in the European property market

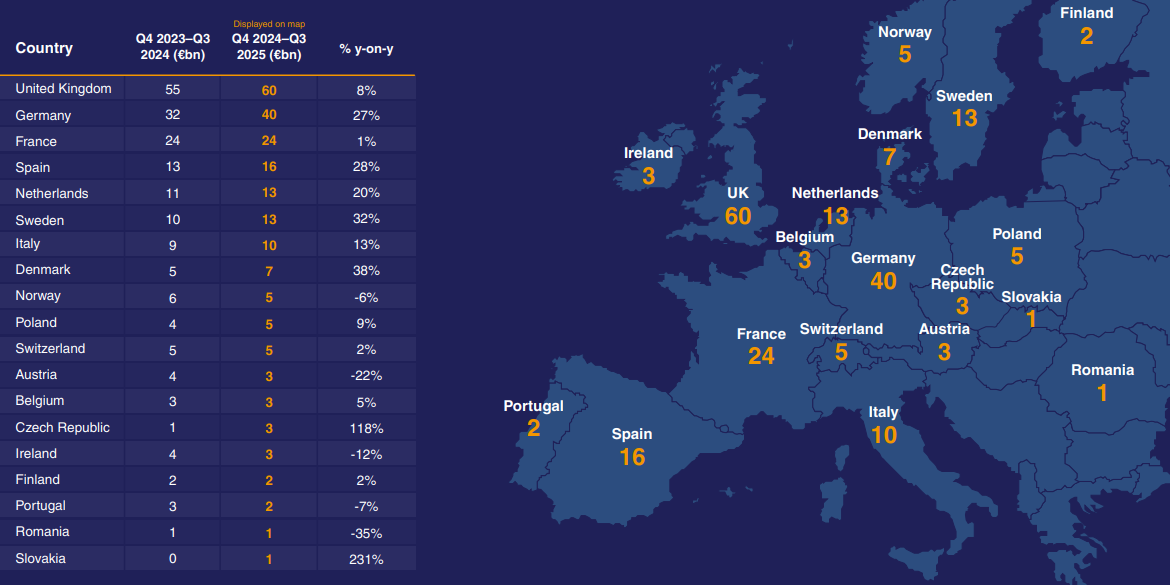

Portugal ranks as the seventeenth-largest European market in property investment over the past year, with around €2 billion in transactions.

The UK leads with €60 billion, followed by Germany (€40 billion) and France (€24 billion). Close behind Spain are the Netherlands and Sweden (both €13 billion) and Italy (€10 billion).

PwC and ULI note that the top seven European markets captured over €100 billion in property investment, with double-digit growth becoming increasingly common.