"House prices have grown faster than salaries in more than half of the 35 countries" that make up the Organisation for Economic Co-operation and Development (OECD), highlights the International Monetary Fund (IMF). And in this regard, Portugal is the country with the greatest difference between these two figures - in other words, where house prices have risen the quickest in relation to family incomes, with a ratio of 133. But what's behind the increase in house prices?

Looking at the ratio that relates the rise in house prices with the increase in salaries in OECD countries, it is clear that Portugal is at the top of the list, considering data from the fourth quarter of 2020. Next in line is Luxembourg, also with a ratio of 133 - the same as Portugal. Austria, Hungary, the Netherlands and Germany are other countries where this difference in evolution is equal or higher than 125. On the other hand there are countries like Lithuania, Finland and Estonia where this divergence is less notable.

"Increases in house prices relative to income make housing unaffordable for many segments of the population", highlights the IMF in its latest study on affordable housing in Europe.

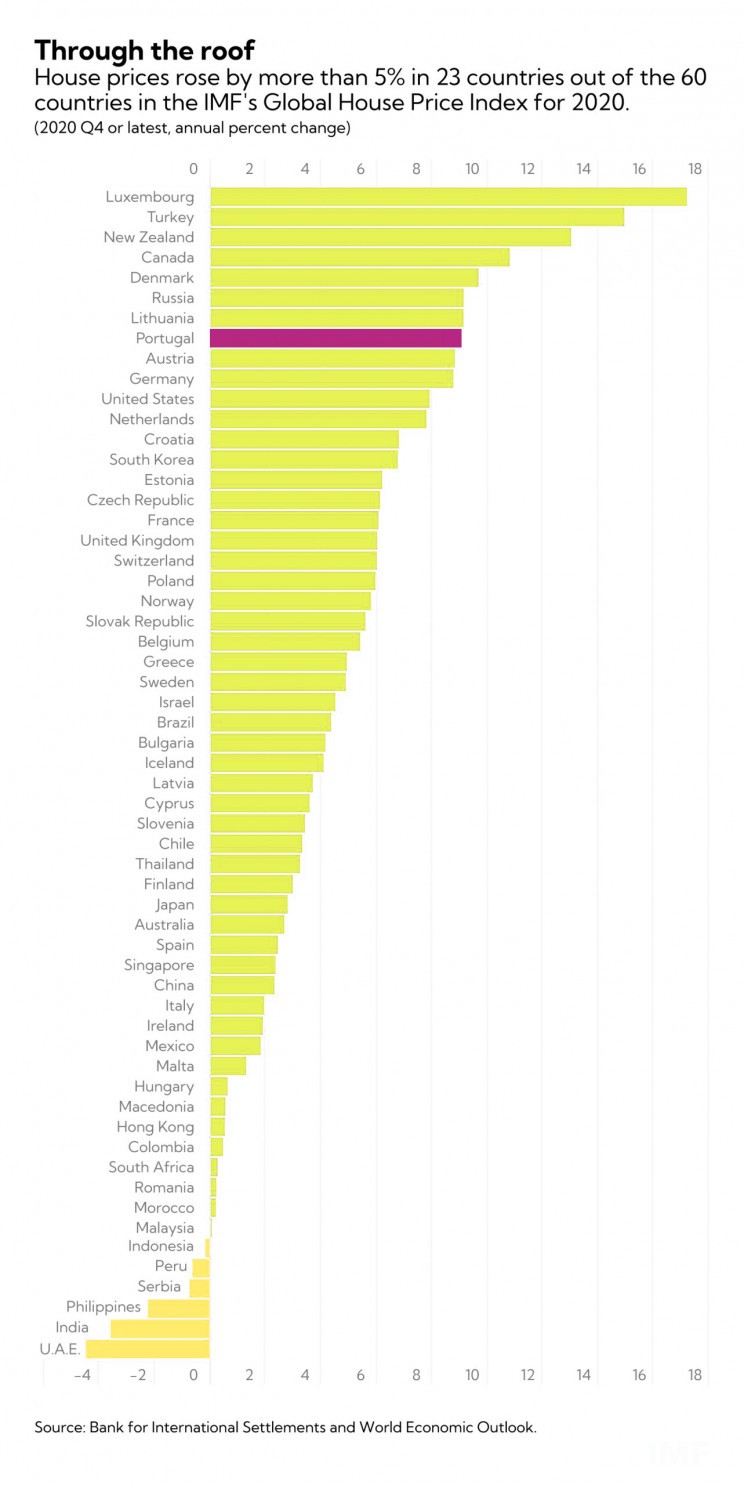

House prices jumped in most of 60 countries

Regarding the evolution of house prices in 60 different countries, the IMF reports that "three-quarters of them recorded increases in house prices during 2020 and this trend continued in most countries", according to the most recent data. It also reported that "house prices rose by more than 5% in 23 countries out of 60 in the IMF Global House Prime Index for 2020", considering the annual change in the fourth quarter of 2020.

In this analysis, Luxembourg appears in first place with a house price increase of around 17%. In second place is Turkey with a 15% change, and in third place is New Zealand with 13%. In this regard, Portugal is the eighth country out of the 60 analysed by the IMF, where house prices have risen the most - registering a jump of around 9% in this period.

Amongst the smallest rises in this period is Hong Kong, where some of the most expensive properties in the world can be found. And leading the decreases in house prices is the United Arab Emirates, with a decrease of more than -4%. Also among the negative developments registered is India (-3%), the Philippines (more than -2%), Serbia (-1%), Peru, Indonesia and Malaysia, with a reduction of less than -1%.

What is behind the rise in house prices?

According to the IMF's analysis, the boom in house prices during the pandemic is due to the combination of several factors. To begin with, there were the interest rates on mortgages, which reached historic lows. Then, there were several measures taken by governments around the world that helped minimize the effects of the crisis generated by the Covid-19 pandemic on the wallets of many families, such as, for example, pushing millions of people into teleworking and creating measures to avoid mass unemployment, as was the case of 'lay-off' in Portugal.

Alongside the confinement, which led to a slowdown in consumption, this increased the savings of many families around the world. In Portugal, household deposits even reached historic levels in July 2021, reaching €169,910 million, the Bank of Portugal recently revealed.

On the other hand, the time spent at home has not only drawn people's attention to the importance of valuing the spaces of the home - especially outdoor spaces such as gardens and balconies - and led many to search for homes online. According to the IMF, the search for homes on the internet has skyrocketed in several countries and has even reached record levels in the United States, for example.

All these factors influenced the increase in demand, for a supply of houses that in some markets - such as Portugal - is structurally scarce. The construction industry followed its course during the pandemic - proving resilient - but it has seen its activity affected by interruptions in the supply of materials, by the increase in the price of materials, and also by the shortage of labour, points out the IMF. All of this has slowed construction processes around the world and, as a result, has delayed the bringing of more homes to market.

It is this imbalance between demand and supply of housing that is responsible for much of the buoyancy in property markets during the pandemic, concludes the IMF, which also stresses that politicians and governments around the world are closely monitoring developments in the sector.

And what are the possible futures?

Some people are drawing a bleak scenario for the world economy, especially when thinking about the possibility of a fall in house prices in China, as a result of the current real estate crisis the country is experiencing. This crisis, which was largely generated by the liquidity problems at Evergrande and other real estate developers in the country, was pointed to by The Economist in its latest report on the risks to global economic growth.

But on this point the IMF paints a more "plausible" scenario, in which there are rising interest rates on home loans, the withdrawal of political support as economies begin to recover and a restoration of the supply of building materials. All of this, if it materialises, could even "lead to some normalisation of house prices", it concludes.