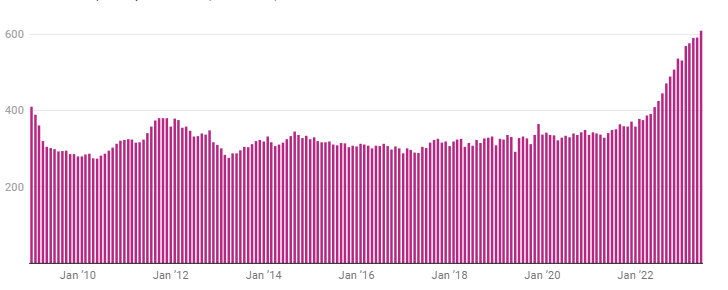

Most home loans in Portugal have a variable rate, which is why interest and instalments have been updated according to the Euribor term (3, 6 or 12 months). And they keep getting bigger. The National Statistics Institute (INE) revealed on Wednesday that the implicit interest rate on housing loans as a whole was 3.649 percent in June, the highest since April 2009. As a result, the housing instalment has risen again to 361 euros on average, more than half of which is used to pay interest.

"The implicit interest rate on all mortgage contracts was 3.649 percent in June, the highest since April 2009, up 25.1 basis points (b.p.) on May (3.398 percent)," explains INE. It should also be noted that for house purchase financing - the "most relevant" in housing loans as a whole - the implicit interest rate for all contracts rose to 3.631% (+24.8 b.p. compared to May), explains the bulletin published on Wednesday 19 July.

Implicit interest rate on housing loans (%)

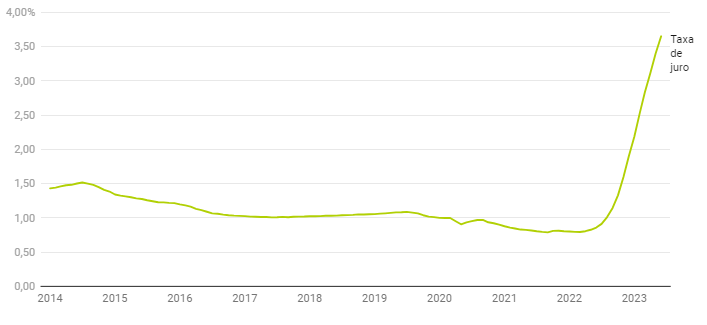

As interest rates rose, housing instalments also became more expensive in June. Looking at all contracts, the average monthly instalment stood at 361 euros in June, 9 euros more than in May. And it went up by 100 euros compared to June 2022 (an increase of 38.3 percent).

What is also very noticeable is that the interest has represented more than half of the instalment on the house for two months in a row. Of the 361 euros in instalments, 192 euros (53%) correspond to interest payments and 169 euros (47%) to amortised capital. This contrasts with the breakdown of housing instalments seen a year ago, when interest represented just 16% of the average instalment (261 euros). This means that the weight of interest on the housing instalment has more than tripled in a year.

With the lower amortisation of capital in the instalments (among other factors), the average capital outstanding for all home loan contracts rose 127 euros in June compared to the previous month, standing at 63,296 euros.

Evolution of the average value of the house payment (euros/month)

Interest at 4% and instalments at 600 euros for contracts signed since April

In the case of the most recent housing loans, the reality is much worse. Interest rates are skyrocketing to 4 percent and housing instalments are rising to 600 euros, given the rise in the cost of bank financing in recent months.

"In contracts signed in the last three months, the interest rate rose from 3.882 per cent in May to 4.132 percent in June, reaching the highest value since May 2012," explains the institute. And for contracts signed in the last three months for house purchase, the interest rate rose by 25.2 b.p. compared to the previous month, standing at 4.123 percent.

In these home loans signed between April and June, the average instalment rose by 18 euros compared to the previous month, to 609 euros in June (an increase of 48.9 percent compared to the same month last year).

On the other hand, the rise in interest rates has made access to home loans more difficult, with families buying cheaper homes and borrowing less capital, as reported by idealista/news. This may help explain the fact that the average outstanding amount of contracts signed in the last three months was 122,570 euros in June, 1,495 euros less than in May.

Payment for the house in contracts signed in the last 3 months -Average value of the house payment (euros/month)