The global economic context continues to present challenges and uncertainties. However, the luxury real estate market remains resilient. Evidence of this is that the prices of luxury homes continue to rise in most major cities around the world, with Lisbon leading the increases in the first six months of 2024 (+4.2%). Furthermore, rents for prime properties are rising even more.

The latest "Prime Residential World Cities Index" report from Savills examined the performance of the luxury residential market in 30 major global cities. It concluded that both the prices of homes for sale and prime rents continued to increase in the first half of 2024, demonstrating the resilience of this segment of the real estate market.

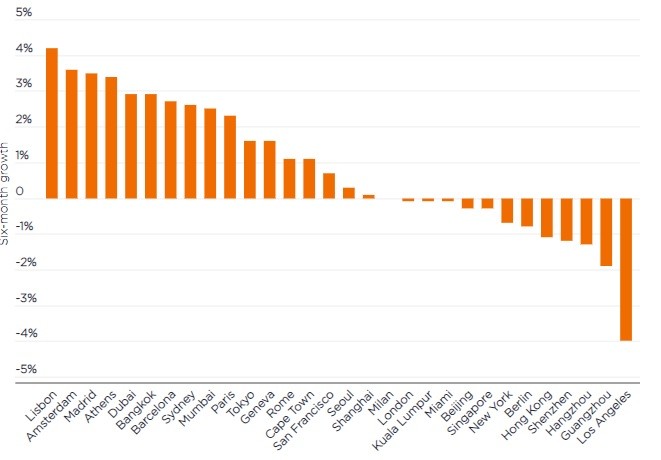

Buying luxury homes: Lisbon leads price increases

The majority of cities analysed worldwide (60%) recorded positive growth in the cost of luxury homes, with an average price increase of 0.8% in the first half of this year. Although the price rise is modest, this result reflects a high level of confidence among investors, who continue to see luxury properties as a safe haven and a good investment opportunity.

European cities have been the primary drivers of this growth in the cost of luxury homes: Lisbon led with the largest price increase (+4.2%), followed by cities such as Amsterdam, Madrid, and Athens, all with increases exceeding 3%.

However, there are cities that have seen luxury home prices fall in the first half of 2024, such as Los Angeles in the USA, which experienced a decrease of 4% (the largest drop). Another example is Hong Kong, which is undergoing a real estate crisis, where prices have dropped by about 1%. New York and Berlin are also on the list of declines.

These data illustrate how the dynamics of the luxury real estate market vary from one geography to another, with demand being influenced by local and international factors.

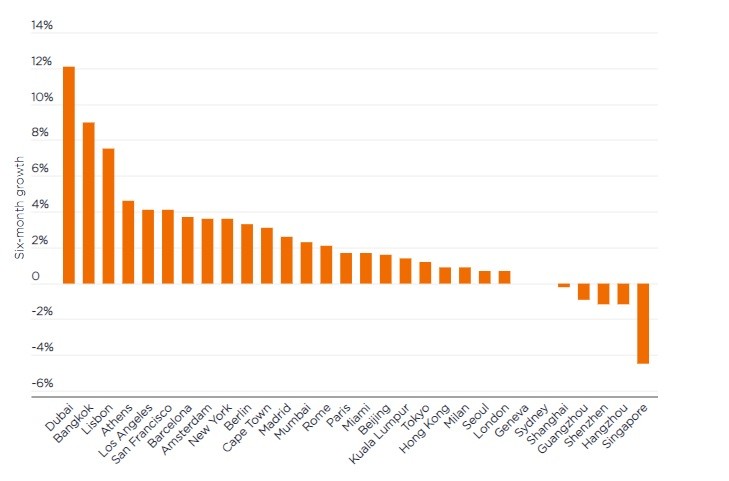

Luxury home rentals: Lisbon in the top 3 for increases

The growth in prices was even more pronounced in the prime rental market, recording an average increase of 2.2% in the first half of the year. Around 25 of the 30 monitored cities experienced stable or positive rent growth, with some locations significantly exceeding the global average.

Dubai in the United Arab Emirates is a prime example, with rent growth of 12.1%. The top three cities for the largest increases in luxury rents are completed by Bangkok (+9%) and Lisbon (+7.5%).

These data illustrate how the prime rental market in these cities has been strongly driven by growing demand. Several factors contribute to this demand, including rising mortgage costs, which push many potential buyers into the rental market. Additionally, tourism and the return of expatriates have also invigorated the rental sector.

In Europe, cities such as Athens, Barcelona, Amsterdam, and Berlin have recorded significant increases in prime rents, with rises exceeding 3% during this period.

There are also five cities worldwide where luxury rents have fallen during this period, with Singapore leading the declines (over 4%).

How will luxury real estate evolve by the end of 2024?

Looking ahead to the second half of 2024, Savills expects that rents for luxury homes will continue to rise, supported by limited supply in many cities and still high construction costs.

However, the international property consultancy acknowledges that there could be a change in luxury home sales if there is a significant reduction in interest rates in the second half of the year. This is because lower interest rates could encourage more buyers to proceed, thereby alleviating pressure on rents.

Regarding real estate transactions, forecasts for the second half of 2024 indicate slight growth, driven by persistent demand for luxury residential properties in some of the major European cities. This is the case in Amsterdam, Lisbon, and Barcelona, where price increases of between 2% and 3.9% are expected by the end of the year.