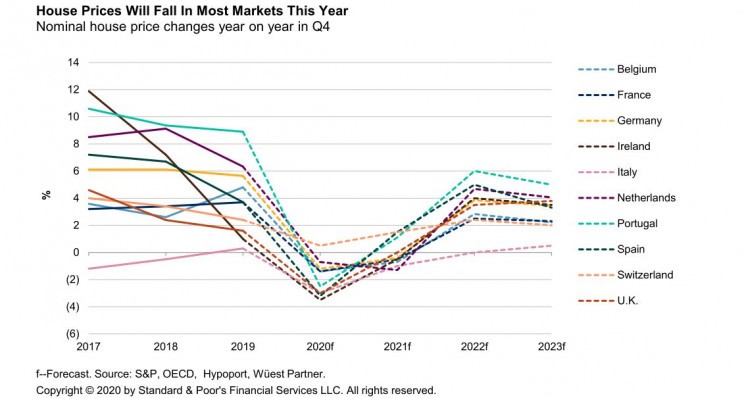

House prices are expected to fall in almost all major European markets this year due to the economic effects of the COVID-19 pandemic, according to findings by economists at Standard & Poor's (S&P) Global Ratings. The financial ratings agency predicts a 2.5% drop in house prices in Portugal after prices were on the rise before the crisis, but points to a rapid recovery and strong growth by 2022.

S&P carried out an analysis of the residential market in Europe in a recent report titled "Government job support will stem European housing market price falls", dealing mainly with the consequences of the COVID-19 crisis. The results also show a promising future, as they point to minimal falls in prices in general.

"We estimate that house prices will fall between 3% and 3.5% in Ireland, Italy, Spain and the UK, 2.5% in Portugal and between 1.2% and 1.4% in Belgium, France and Germany," says Boris Glass, senior economist at S&P Global Ratings, quoted in a recent communiqué. "Only in Switzerland do we expect prices to continue to rise at least 0.5% this year," Glass adds.

Employment support can stop falls

Nevertheless, S&P expects the markets to recover faster than expected. The financial ratings agency is confident that prices will rise again quickly by the end of 2022, largely because of the large-scale support implemented by the government. According to S&P, the support is expected to contain unemployment rates and consequently, falls in house prices.

Moreover, S&P highlights the rapid action of the European Central Bank (ECB) in limiting the deterioration of credit conditions and considers that monetary policy should "continue to be extremely flexible and favourable even when economies recover".

"Currently, households are accumulating savings", something that, in Glass's opinion, "should help sustain the recovery of the economy and the housing market, since measures to contain the virus are being lifted and economies will gradually begin to return to normality", Glass adds.

However, the financial ratings agency warns in the report that forecasts may be revised again if there is a further outbreak of the coronavirus in the autumn or if the employment market does not respond positively to measures implemented by European governments.