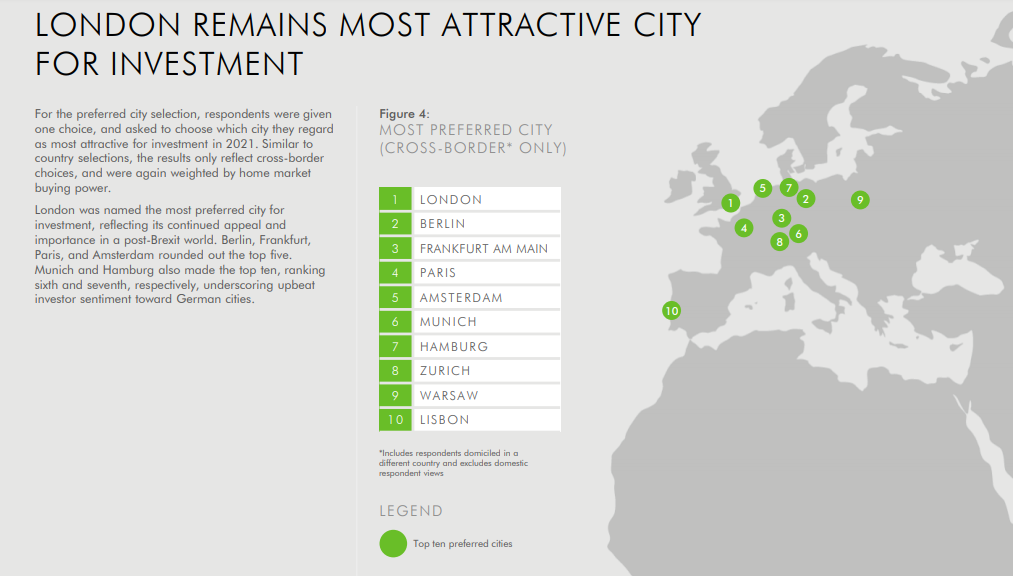

Lisbon is one of the 10 most attractive European cities to invest in real estate in 2021, occupying precisely the tenth position. The Portuguese capital is part of a list led by London (United Kingdom). The German cities Berlin and Frankfurt occupy the second and third places of the podium, respectively. This is one of the conclusions to be drawn from the report EMEA Investor Intentions Survey 2021, released by the consultancy firm CBRE.

According to the property consultancy firm, "despite the post-Brexit scenario, the British capital maintains its relevance as the most attractive city for property investment in Europe. With 4 cities in the list of investors' top 10, Germany is expected to lead the recovery of investment in Europe," CBRE said in a statement.

The report concludes that, overall, about 60% of European investors plan to invest more in real estate this year than in 2020, a year marked by the arrival of the COVID-19 pandemic. It should also be noted that the majority of investors (almost 75%) indicated they want to buy 10% or more this year compared to last year, although there are some noticeable differences between countries. In the United Kingdom, for example, more than 80% of investors expressed the desire to invest more capital, according to the study.

Much has been made of the fact that working from home is an increasing trend to consider in a forward-looking scenario, however in spite of this offices continue to be considered the preferred asset class for European investors.

"35% of those who participated in the study indicated that office space is the preferred area within the real estate sector, reflecting a positive market sentiment about the future of quality offices (known as Class A). On the other hand, the residential sector gains increasing importance by being highlighted as the second most popular real estate asset class with 24% of intentions, followed by the industrial and logistics sector at 22%. Thus, Class A offices, industrial and logistics and housing are the sectors where prices are expected to remain strongest (...)," the document states.

Quoted in the note sent to the press, Cristina Arouca, director of the Research area of CBRE Portugal, said that investment in commercial real estate took off timidly in the country in 2021, "due to the general coronavirus lockdown in Portugal, including restrictions on travel and visits to properties, reflected in a strong slowdown in investment activity during the first 3 months of the year".

Nuno Nunes, director of Capital Markets at CBRE Portugal, considers that there continues to be a high level of interest in the national real estate market, both for high level investors and expat buyers and predicts, in this sense, a very dynamic second semester in Portugal, especially in Lisbon: "Portugal is perfectly within the radar of the international investment community and, at a national level, we foresee very positive developments in the investment capacity of local players. There are currently more than 2.4 billion euros of assets being marketed or with processes underway to be launched to the market soon, leading us to anticipate an investment volume for the year of approximately 2.5 billion euros. With an amount slightly below the one observed last year (of 2.9 billion euros), it is still quite relevant for the national market".