The real estate segment focussed on offices in Europe, especially the development of greenfield projects and/or the rehabilitation of old buildings, continues to offer interesting investment opportunities both for investors with a core profile and for investors with a value-added profile in Europe. The two major Portuguese cities of Lisbon and Porto are on the radar of these investors.

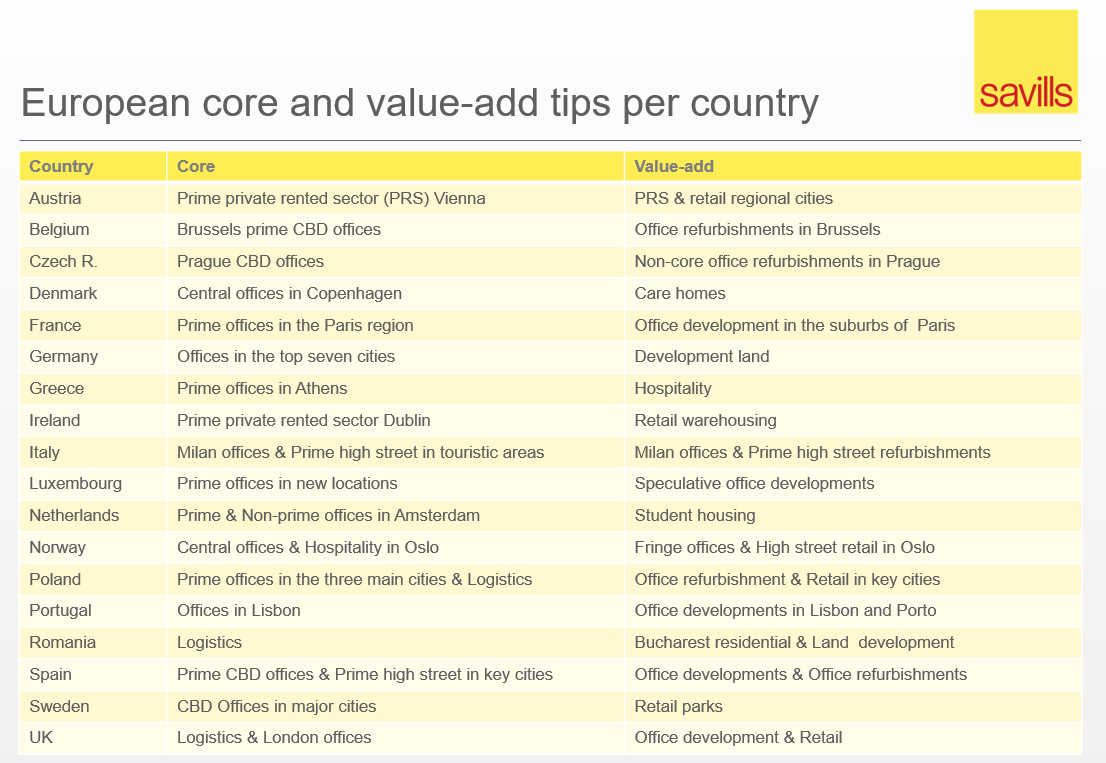

According to a study by the consultancy firm Savills, which aims to identify where the main real estate investment opportunities are in Europe, there has been a "significant demand for modern facilities" – offices – all over the continent.

"In some countries, other asset classes, such as hotels, the private rented sector (PRS), student residences and retirement homes, have attracted investors. The main focus has been on the growth of the rental market, the opportunities arising from the development and repositioning of assets, both in terms of use and location, and the long-term guaranteed income from traditional commercial assets and alternative assets," the company says in a statement.

For Paula Sequeira, Investment Director-Capital Markets at Savills Portugal, "in Portugal, the retail and office sectors have been among the most targeted by core investors in recent years… The growing demand for office space, in particular by shared services and coworking companies, which has not been properly matched on the supply side of things, has created a window of opportunity for investment in the development of office buildings."

The housing rental market, sustained by the demand generated by "unusual sectors", such as "student housing" and "senior living" residences and apartments for expatriates, has been attracting increasing interest from investors, she said.

According to Marcus Lemli, European Investment Director of Savills, "Europe remains an attractive investment proposition for investors".

Based on figures from the first three quarters of the 2018 fiscal year, Savills expects Ireland, Poland, Portugal and Greece to stand out, showing annual increases of approximately 80%. "We predict that offices will continue to be the most sought-after asset class, despite yield compression. However, investors willing to look at countries from the perspective of cities and asset classes can still identify opportunities with yields above 5% in Europe," the document says.